by Swot Accoountants | Nov 4, 2025 | Business News, Business Training, Companies & Trusts, Fringe Benefit Tax (FBT), GST

Expanding a business is an exciting milestone, but growth comes with risks. Scaling too early or without the proper financial foundation can strain resources and jeopardize your operations. To make informed decisions, business owners need to assess specific financial...

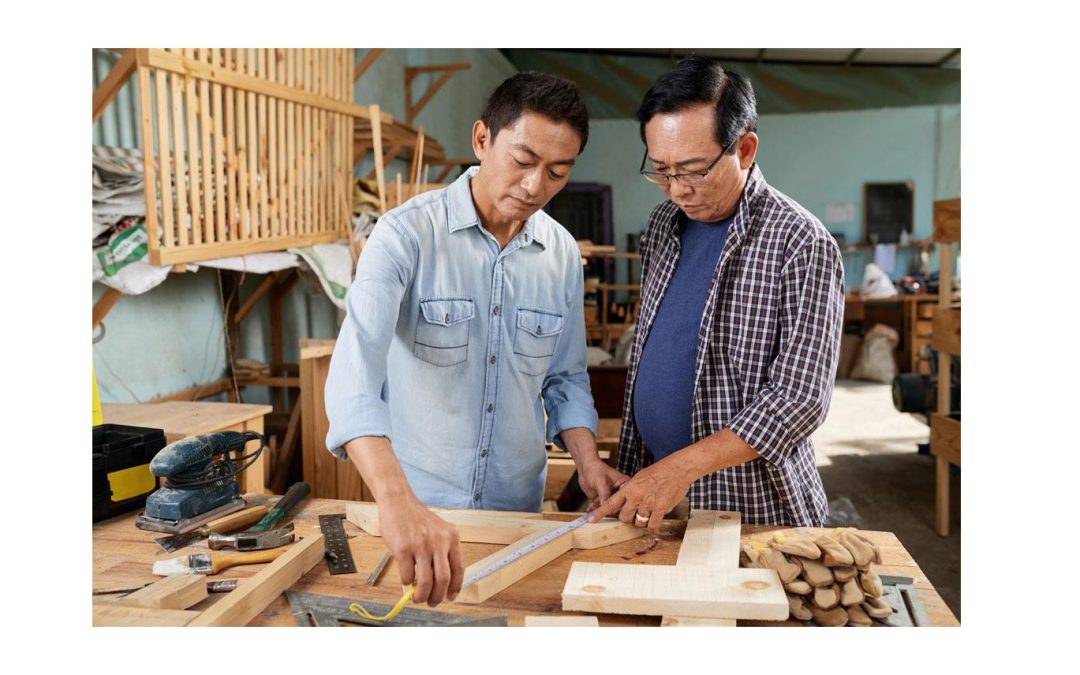

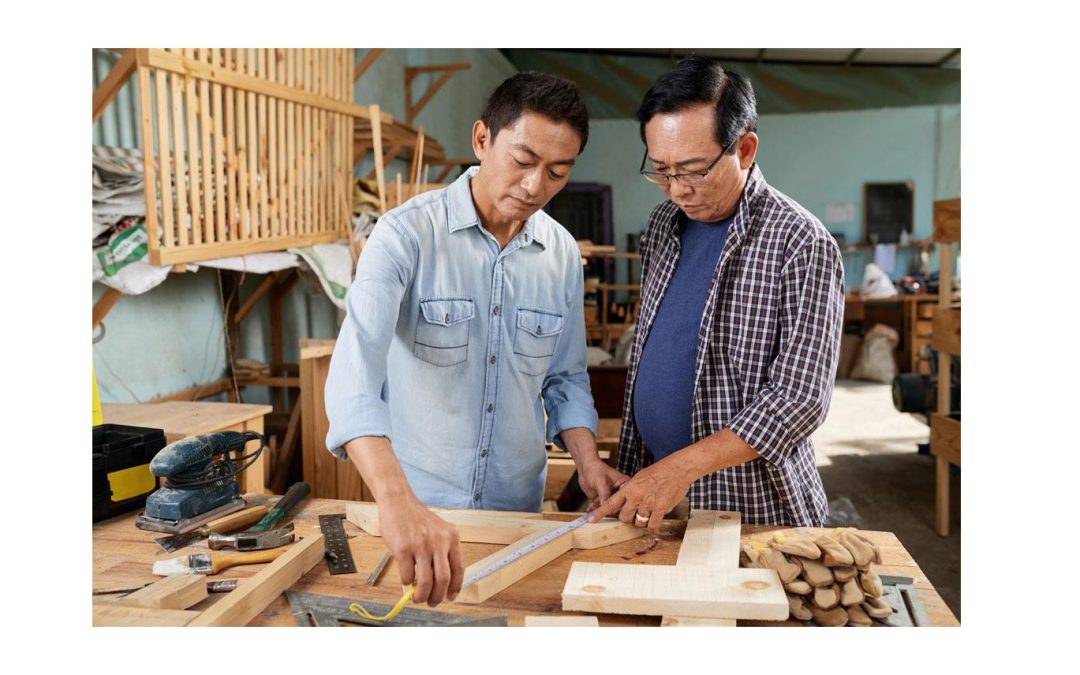

by Swot Accoountants | Aug 4, 2025 | Business News, Fringe Benefit Tax (FBT), Tax & Compliance

Hiring family members in your small business isn’t just a great way to keep things in-house, it can also offer some valuable tax advantages. That said, there are a few important rules to follow to ensure you’re staying compliant with Australian tax law....

by Swot Accoountants | May 1, 2022 | Business News, Business Training, Fringe Benefit Tax (FBT), Tax & Compliance, Tax Offset

On 29 March 2022, the Treasurer handed down the 2022/23 Budget with changes to tax and superannuation laws. Here is a summary of some of the measures that may impact businesses and individuals. Small Business Technology Investment Boost and Small Business Skills and...

by Swot Accoountants | Mar 7, 2021 | Business News, Fringe Benefit Tax (FBT), Tax & Compliance

Car Fringe Benefits Tax (FBT) is a tax on fringe benefits provided to employees, including company directors (even if no director fees are paid to that director). If a business owns a car and that car is available to an employee for their private use, that employee...

by Swot Accoountants | Nov 13, 2019 | Business News, Fringe Benefit Tax (FBT), Tax & Compliance

In some circumstances if a business provides and pays for Christmas parties for their employees and their associates, it may attract FBT. There are some costs associated with Christmas parties for food and drinks that may be exempt from FBT. For example: Christmas...