by Swot Accoountants | Jan 4, 2026 | Business News, Business Training, Tax & Compliance, Uncategorised

January is a natural reset point for business owners. While the Australian financial year runs from 1 July to 30 June, January sits right at the mid-point of the financial year, making it the perfect time to review performance and adjust course before year-end.For...

by Swot Accoountants | Dec 3, 2025 | Business News, Business Training, Tax & Compliance

Strong financial management is one of the most important foundations of a healthy business. Yet many business owners, especially small and growing businesses struggle to stay ahead of their cashflow, tax obligations and compliance requirements. The problem is often...

by Swot Accoountants | Oct 1, 2025 | Business News, Business Training, Companies & Trusts, Tax & Compliance

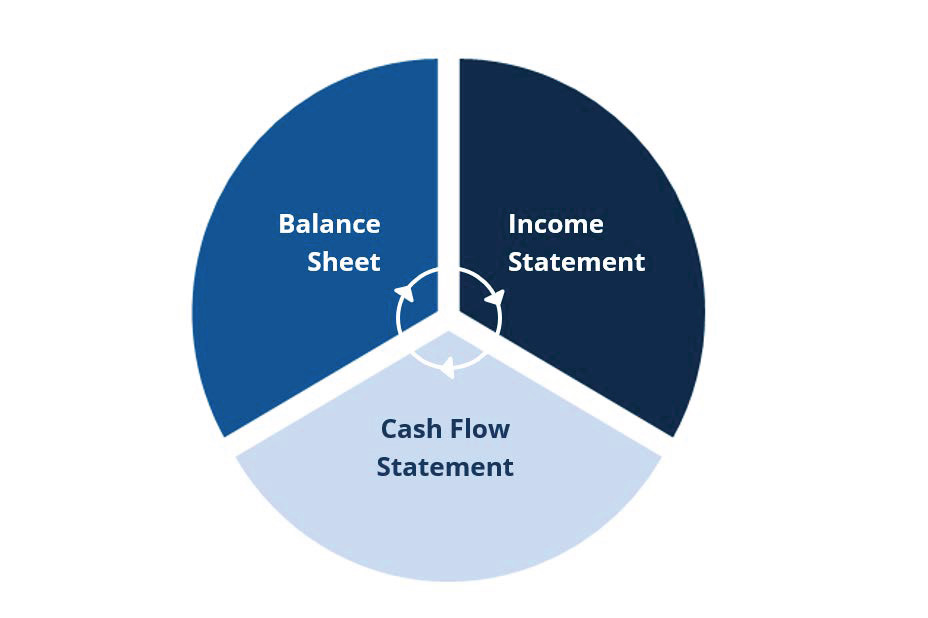

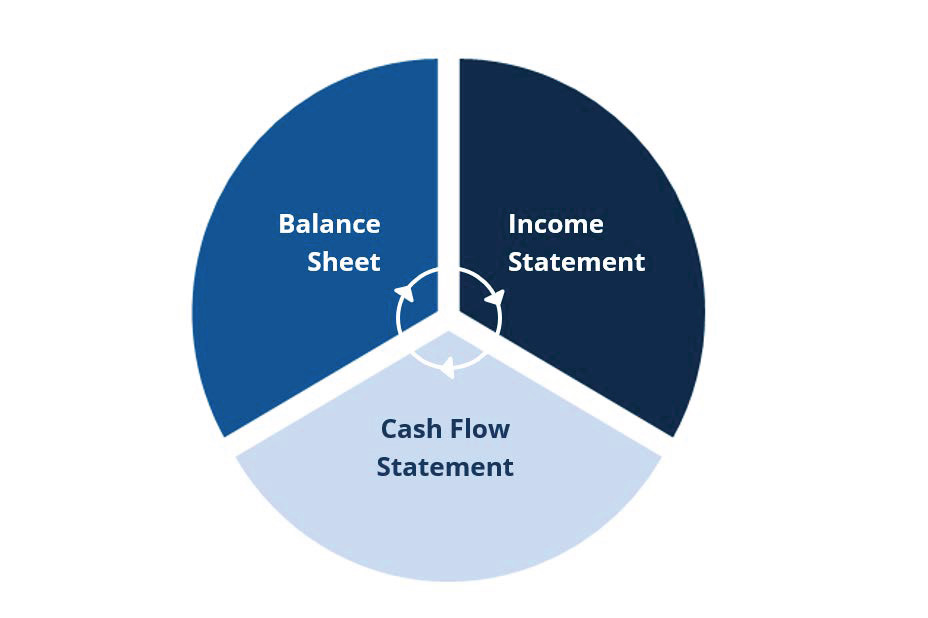

For small business owners in Australia, understanding financial statements is a crucial step in managing your business effectively. Financial statements provide a snapshot of your business’s financial health, help you make informed decisions, and are often required...

by Swot Accoountants | Sep 8, 2025 | Business News, Business Training, Companies & Trusts, Tax & Compliance

A strong budget is one of the most valuable tools you can give your business. It provides clarity, keeps spending under control, and ensures you’re prepared for both opportunities and challenges. Whether you’re just starting out or looking to improve your financial...

by Swot Accoountants | Aug 4, 2025 | Business News, Fringe Benefit Tax (FBT), Tax & Compliance

Hiring family members in your small business isn’t just a great way to keep things in-house, it can also offer some valuable tax advantages. That said, there are a few important rules to follow to ensure you’re staying compliant with Australian tax law....

by Swot Accoountants | Jul 4, 2025 | Business News, Business Training, GST, Payroll, Super, Tax & Compliance

Tax time doesn’t have to be stressful, yet every year, many taxpayers make avoidable mistakes that lead to delays, ATO scrutiny, or missed deductions. Whether you’re an individual taxpayer or running a business, avoiding these common tax mistakes can save you...