by Swot Accoountants | Nov 4, 2025 | Business News, Business Training, Companies & Trusts, Fringe Benefit Tax (FBT), GST

Expanding a business is an exciting milestone, but growth comes with risks. Scaling too early or without the proper financial foundation can strain resources and jeopardize your operations. To make informed decisions, business owners need to assess specific financial...

by Swot Accoountants | Oct 1, 2025 | Business News, Business Training, Companies & Trusts, Tax & Compliance

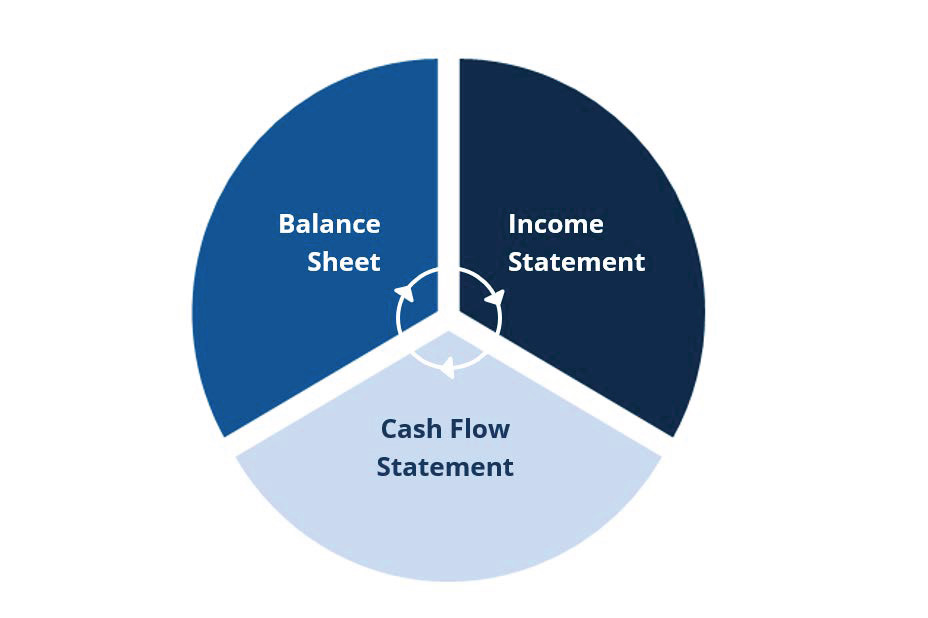

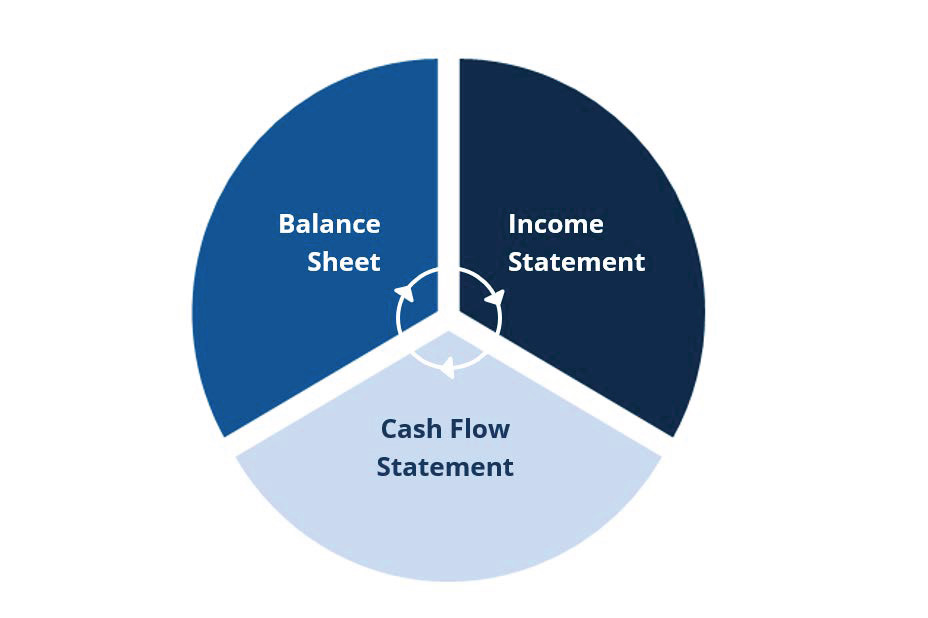

For small business owners in Australia, understanding financial statements is a crucial step in managing your business effectively. Financial statements provide a snapshot of your business’s financial health, help you make informed decisions, and are often required...

by Swot Accoountants | Sep 8, 2025 | Business News, Business Training, Companies & Trusts, Tax & Compliance

A strong budget is one of the most valuable tools you can give your business. It provides clarity, keeps spending under control, and ensures you’re prepared for both opportunities and challenges. Whether you’re just starting out or looking to improve your financial...

by Swot Accoountants | Mar 5, 2025 | Business News, Business Training, Companies & Trusts, Tax & Compliance

Starting a business is an exciting journey, but managing finances effectively is crucial for long-term success. Many startups overlook the importance of a good accounting system, only to face financial challenges down the road. Whether you’re just launching or scaling...

by Swot Accoountants | Jul 20, 2024 | Business News, Business Training, Companies & Trusts, Tax & Compliance

As tax season rolls around, Australians are warned to stay vigilant against increasingly sophisticated scams aimed at stealing personal information. The Australian Tax Office (ATO) and other institutions are alerting everyone to be cautious, especially during the...

by Swot Accoountants | Mar 1, 2022 | Business News, Companies & Trusts, Tax & Compliance

The ATO has released public advice and guidance (PAG) products relating to the tax treatment of trust entitlements arising out of reimbursement agreements and unpaid present entitlements (UPEs) of trust beneficiaries. The following draft products have been released...