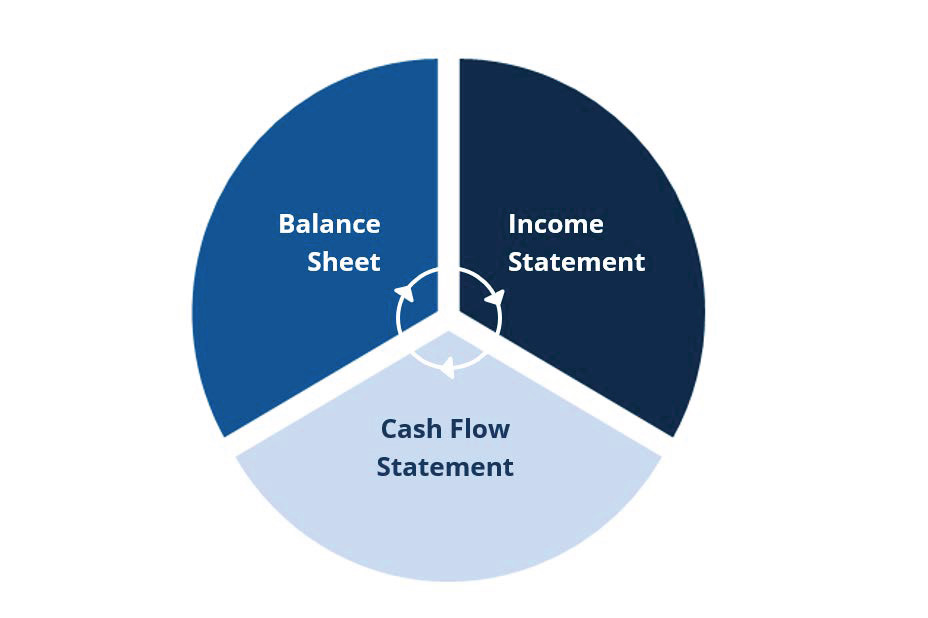

For small business owners in Australia, understanding financial statements is a crucial step in managing your business effectively. Financial statements provide a snapshot of your business’s financial health, help you make informed decisions, and are often required for tax compliance, loan applications, or investor reporting. This guide breaks down the essential financial statements and why they matter.

1. Balance Sheet

The balance sheet provides a snapshot of your business’s financial position at a specific point in time. It outlines your:

- Assets: What your business owns, such as cash, inventory, and equipment.

- Liabilities: What your business owes, including loans, unpaid bills, and taxes.

- Equity: The value remaining for the owners after liabilities are deducted from assets.

Why it matters:

A balance sheet helps you understand your business’s solvency and financial stability. It can highlight areas where you may need to reduce debt or increase assets.

2. Income Statement (Profit & Loss Statement)

The income statement shows your business’s performance over a period, typically monthly, quarterly, or annually. It outlines:

- Revenue: The money earned from sales or services.

- Expenses: Costs incurred to run the business, such as rent, salaries, and utilities.

- Net Profit or Loss: The difference between revenue and expenses.

Why it matters:

The income statement provides insight into your business’s profitability. It helps you identify trends, manage costs, and plan for future growth.

3. Cash Flow Statement

The cash flow statement tracks the movement of cash in and out of your business. It is divided into three sections:

- Operating Activities: Cash generated or used in your core business operations.

- Investing Activities: Cash spent or received from purchasing or selling assets.

- Financing Activities: Cash from loans, investors, or repayment of debt.

Why it matters:

Even profitable businesses can run into trouble if they lack cash. The cash flow statement helps you ensure you have enough liquidity to meet your obligations, pay staff, and invest in growth opportunities.

How Financial Statements Help Small Business Owners

- Informed decision-making: Understand where your money is going and identify areas to cut costs or invest more.

- Compliance: Ensure your business meets ATO reporting requirements and avoids penalties.

- Funding and growth: Lenders and investors often require financial statements before providing funding.

- Performance monitoring: Track profitability, cash flow, and overall financial health to make strategic decisions.

Final Thoughts

Understanding your financial statements doesn’t require an accounting degree, but it does require regular attention. By keeping a close eye on your balance sheet, income statement, and cash flow, you can make smarter business decisions, stay compliant, and plan for sustainable growth.

If you’re a small business owner looking for guidance on interpreting your financial statements or improving your financial reporting, our team at SWOT Accountants can provide expert advice tailored to your business.